Instructions For Business Using Accounting Software

Below are the instructions and details of the records you’ll need to provide to us, to prepare your limited company accounts

1. Business bank statements

Send us the business bank statements covering the full 12-month period in both CSV and PDF formats.

Scroll down to learn how to extract bank statements in the CSV format from your online bank account.

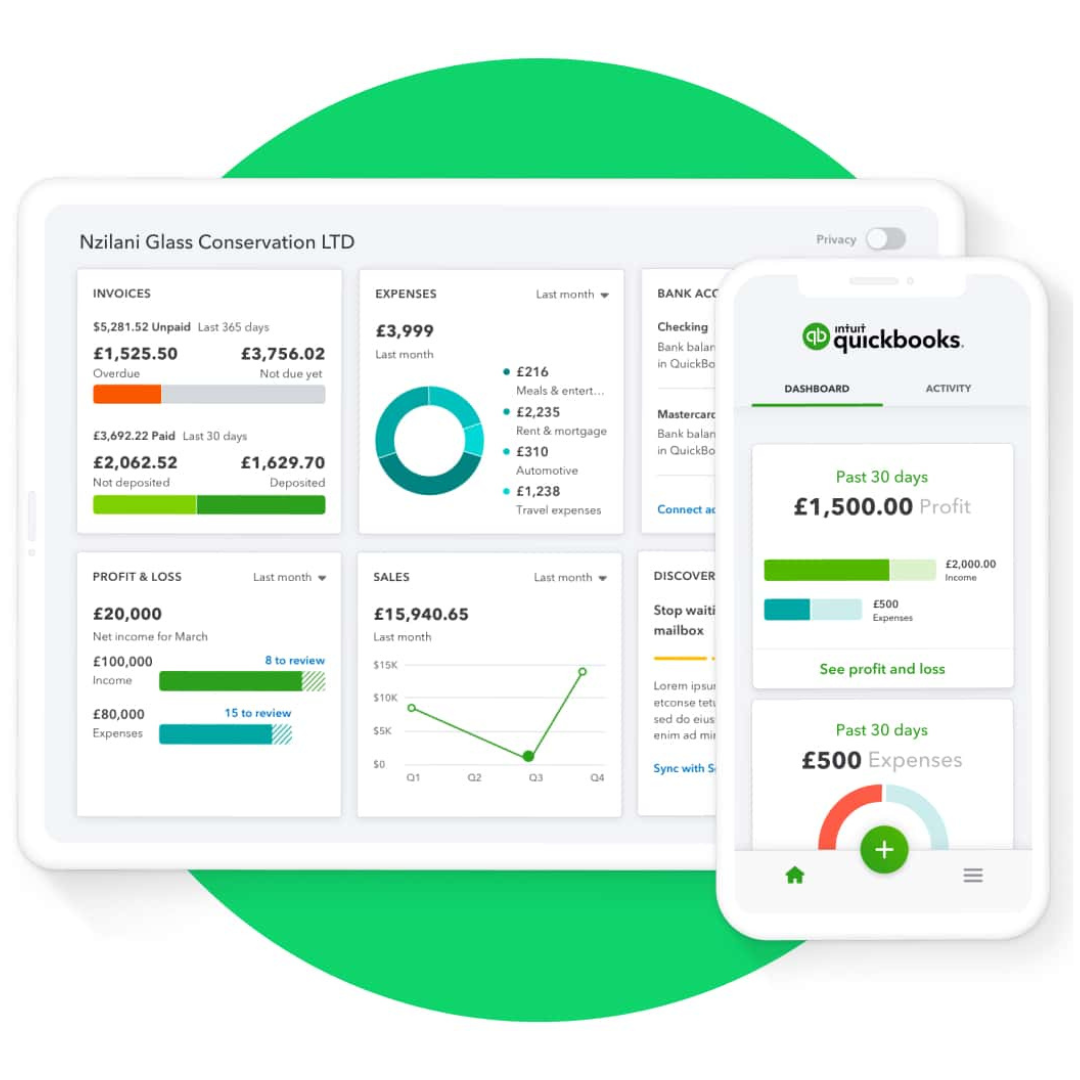

2. Access to your business accounting software

If you haven’t already, please add us as your accountant to your accounting software, allowing us to view and collaborate with you.

3.Year-end ready information

Please ensure that bank reconciliation has been completed and all income and expense transactions have been added to your business accounting software.

Without complete records, it is not possible to prepare accurate company accounts.

If you require assistance with the above tasks, our team can complete these for you (fees will apply for work outside the scope of services).

Additional information we require (if applicable)

If you have any questions or need further support, please contact us on:

0330 043 1967,

contact@accountsgeek.co.uk

07735 199458

Click on each toggle below to expand and view additional information

Provide dividend figure paid to shareholders during the accounting period.

If available, supply us with copies of the dividend vouchers.

If you’re not using our payroll service, please provide the following payroll records:

- employee payslips

- RTI reports

- payroll summary report

If you’re registered for VAT and are not using our VAT service, please provide the following VAT records:

- VAT returns

- VAT detailed reports

Provide details of any salaries, bonuses, or benefits received by company directors.

Provide details of any director out-of-pocket expenses incurred during the accounting period.

An out-of-pocket expense is when you pay for something related to your business using your own money. This could be buying supplies, paying for travel, or any other costs you cover yourself.

Provide details of all fixed assets* owned by the company including:

- their purchase dates

- how much they cost

- any adjustments for wear and tear over time

*Fixed assets are things a company owns that aren’t expected to be turned into cash within the next year.

For example company vehicles, buildings, computer equipment and furniture and fixtures

Information on mileage incurred using your personal vehicle for business-related journeys.

Kindly include the dates of travel, destinations, the purpose of the journeys, and total miles travelled.

A summary of any personal money or capital you have introduced into the company.

This includes both cash injections and any other forms of financial contributions made during the year.

Provide business bank loan statements covering the full 12-month period, in both CSV and PDF formats.

How to extract CSV bank statements

Short guides explaining how to login and download business bank statements in CSV format.

Click on each toggle below to expand and view additional information

Quality of your records

To avoid any additional charges, please ensure the records are provided in the correct formats mentioned above.

Please note, additional fees may apply if we’re required to carry out work to export the business accounting data on your behalf to prepare the accounts.

Wholly and exclusively

When gathering your business records, please remember that all expenses must have been incurred “wholly and exclusively” for the purposes of running the business to be allowable for tax purposes.

This means that the costs must be incurred while actually performing the business or trying to attract more business.