We'll do the accounting, you grow your business

Nationwide tax and accountancy services for businesses and self-employed individuals.

Expert Accountants

Qualified Accountants providing you with expert consultation.

Software

All the tools you need to manage the finances of your business.

Pricing

Less fees and more savings, with our affordable pricing.

Why our customers choose us

Don’t just take our word for it. Read our customers talk about their experience. Join them and enjoy unmatched peace of mind.

We've got you covered

With the 17,000-page tax code, managing self employment can be challenging – whether you’re a business owner, freelancer, landlord or contractor.

An all-in-one accounting solution

- tax returns filed on time and stress free for peace of mind

- access to tax experts

- cover both business and personal taxes

- years of combined experience

- access to our ‘power team’ network

- benefit from our wealth of support and guidance

- support for all major accounting software, letting you choose what works best for you

Who we help... Start ups Freelancers Limited Companies Entrepreneurs Sole traders Health care professionals £1m + turnover businesses

Our customers say:

We'll do the accounting, you grow your business

- Less fees, more savings

- Expert accountants

- Proactive support

Nationwide tax and accountancy services for self-employed individuals and small businesses.

Expert accountancy support

We offer a range of services for self employed individuals and small businesses. From company accounts and VAT returns to self assessments and payroll. Our small business experts are on hand to help.

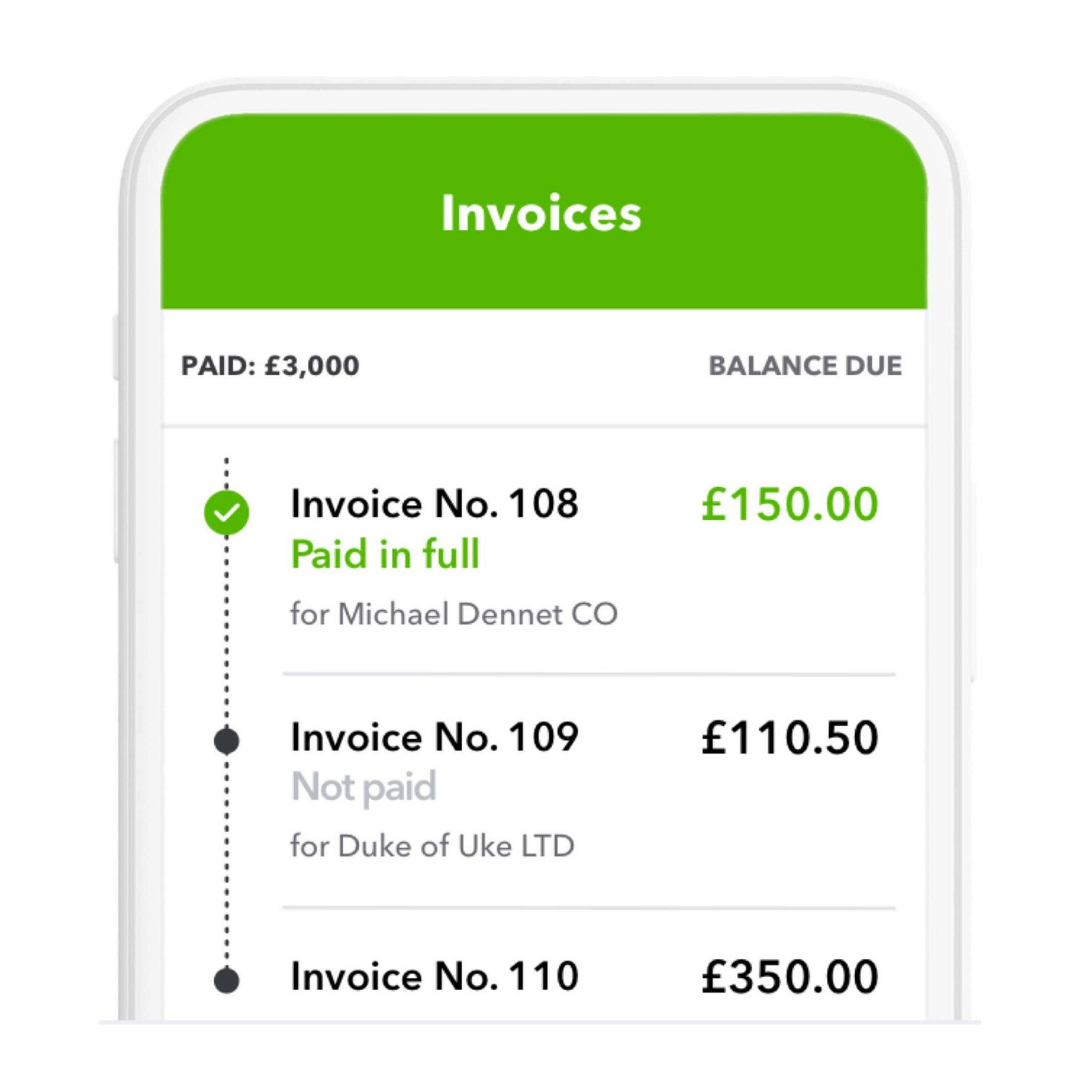

Award winning software

With QuickBooks’ online accounting software, you have all the tools you need to manage the finances of your business. Create professional invoices and snap your receipts - all from your mobile.

Small business accountants

You didn’t start your business, to fiddle around with payroll and HMRC forms. That’s where we come in.

If you have a limited company, a partnership, are self employed or a landlord or just need advice on how to become one of the above, we’ll sort the nitty gritty stuff so you don’t have to. This leaves you to focus on growing your business.

Our tailored accounting services are great value and our pricing is transparent so there are no hidden fees or surprises. As experienced accountants for a wide range of sectors, we are experts in your field and we’re committed to helping you.

Who we help

We understand the needs of freelancers, contractors, start-ups and small businesses, and we’ll support you every step of the way. We help everyone from consultants and designers to plumbers and electricians.

Whether you’re looking to incorporate your limited company or need help preparing and filing your annual accounts, we can help.

We also provide you with QuickBooks, an award winning accounting software, to makes it easy for you to keep on top of your company finances.

Our experts are on-hand to answer your questions and give you advice to maximise your tax efficiency.

Some of the services we can help your company with:

- Incorporate your limited company

- Year end company accounts

- Corporation tax return

- Confirmation statement

- VAT return filing

- Director self assessment tax returns

- Payroll

- Company registered office address

- QuickBooks bookkeeping software

- Bookkeeping

Whether you are venturing into a new partnership or are already established, we can have dedicated accountants who can assist your partnership business with all your tax and accountancy needs.

Here are some of the services we provide partnerships:

- Partnership annual accounts

- Partnership tax return

- Individual partner self assessments tax returns

- Payroll

- VAT tax returns

- Bookkeeping

Although being a sole trader is one of the simplest ways to get started in business, there are many processes that need to be followed. Here are some of the services we can help your sole trader business with:

- Sole trader annual accounts

- Self assessment tax return

- Payroll

- VAT return filing

- Bookkeeping

We help self employed individuals with the following:

- Self assessment tax return

- Self assessment HMRC registration

4 simple sign up steps

Speak with us

Complete our online form and our friendly advisors will contact you.

We set you up

Our friendly experts will help you get everything set up with us and HMRC.

Expert support

Our experts are on-hand to answer any of your questions.

All done

Congratulations, our simple sign up process is complete.

Powerful accounting software for your business

Save around 8 hours a month managing your business with QuickBooks’ all-in-one online accounting software. Whether you’re a small business owner or self-employed, QuickBooks makes it easy to manage your business finances from anywhere.

Track your invoices on the go and keep cash flowing for easy payment. Create and send invoices on the spot, from your laptop, smartphone or tablet. No delays and no piles of paperwork building up.

No more misplaced paperwork. Snap receipts and bills with our easy to use app. You can also email them to your QuickBooks account, individually or in batches.

Take control of cash flow and see all of your bank and credit card transactions in one place. Look 90 days ahead with our cash flow forecaster and access dashboards and reports that help you manage your finances.

Ending your day with a mountain of paperwork? Use our top-rated mobile app to send invoices, create expenses and track payments anytime, anywhere.

Connect your banks and credit cards to QuickBooks for a complete, real-time view of all your finances and cash flow. Save time with reliable data that shows you where you stand.

Making Tax Digital is easy with Accounts Geek.

Whether you’re a sole trader or a limited company, we’ve partnered with a HMRC recognised accounting software (QuickBooks), to help you get ready for MTD.

Whatever your business size – prepare and track VAT returns in an MTD-compliant way. Track income and expenses. Invoice on the spot. Sync your bank account, credit cards and apps to get a clear view of your cash flow.

New customer discount - 10% off accountancy fees

We partner with the best

With Britain’s 17,000-page tax code, managing your business can be challenging – whether you’re a freelancer, landlord, contractor, or a business owner.

That’s why we made it simple. Registration for taxes, filing your personal returns, communicating with HMRC, paying your staff, managing VAT, limited company registration, filing accounts – all covered.

With years of experience helping hundreds of clients, we’ve perfected a streamlined solution.

But we don’t stop at the basics. We’ll help you pay yourself tax-efficiently, maximise allowances, and create a solution tailored to your needs. With our expert team on your side, we’ll make your money work smarter, save you more, and fuel your growth.