Join us

- Free coaching session worth £100

- Spend less time on accounting

- Simple sign up service

- Smooth onboarding process

- Award winning software included (QuickBooks Essential plan)

- Expert support

- Fixed pricing + no hidden fees

Expert accountancy support

We offer a range of services for self employed individuals and small businesses. From company accounts and VAT returns to self assessment and payroll. Our small business experts are on hand to help with any questions you may have.

Award winning software

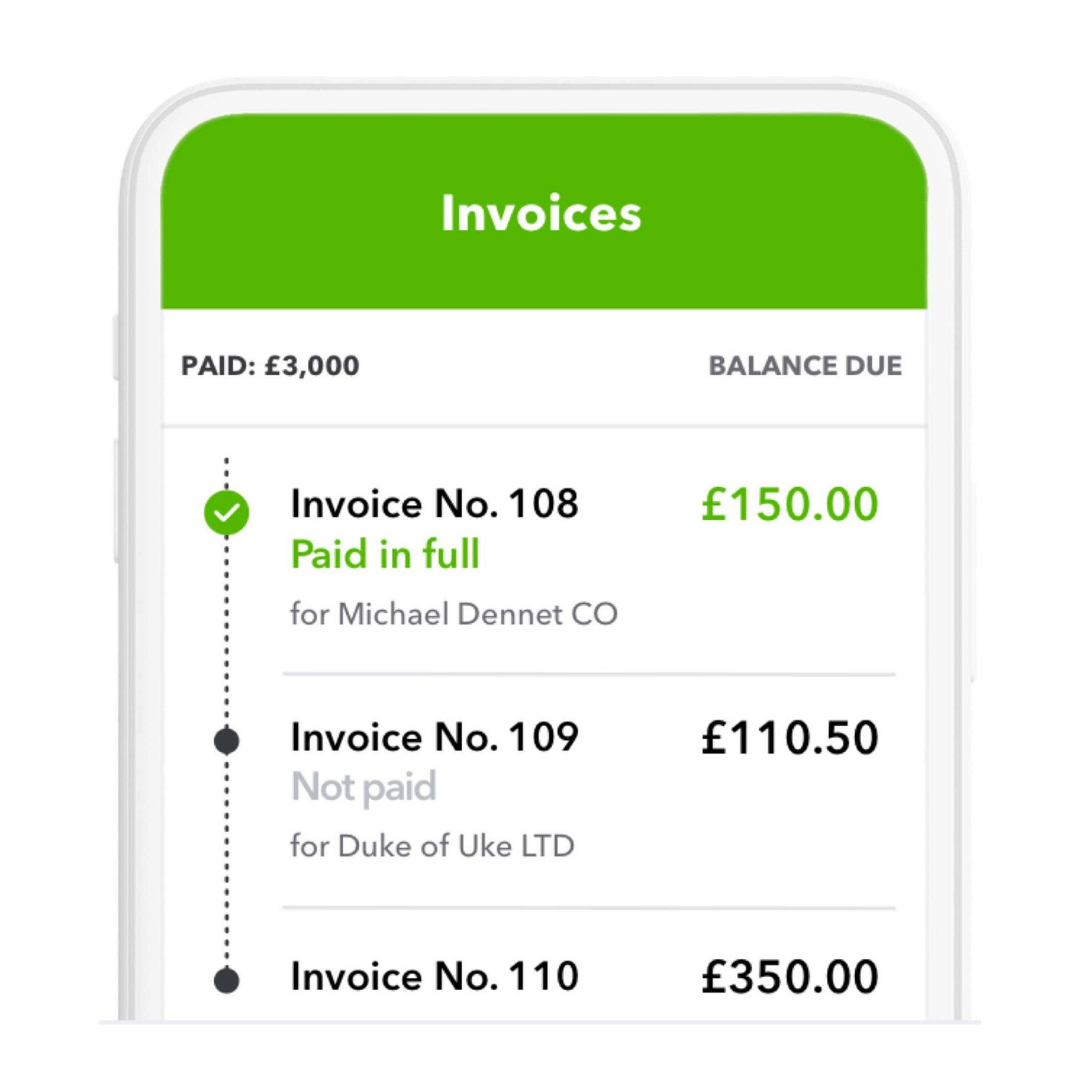

With QuickBooks’ online accounting software, you have all the tools you need to manage the finances of your business. Create professional invoices and snap your receipts - all from your mobile.

Small business accountants

You didn’t start your business/self-employment, to fiddle around with payroll and HMRC forms. That’s where we come in.

If you have a limited company, a partnership, are self employed or a landlord or just need advice on how to become one of the above, we’ll sort the nitty gritty stuff so you don’t have to. This leaves you to focus on growing your business.

Our tailored accounting services are great value and our pricing is transparent so there are no hidden fees or surprises. As experienced accountants for a wide range of sectors, we are experts in your field and we’re committed to helping you.

Who we help

We understand the needs of freelancers, contractors, start-ups and small businesses, and we’ll support you every step of the way. We help everyone from consultants and designers to plumbers and electricians.

Whether you’re looking to incorporate your limited company or need help preparing and filing your annual accounts, we can help.

We also provide you with QuickBooks, an award winning accounting software, to makes it easy for you to keep on top of your company finances.

Our experts are on-hand to answer your questions and give you advice to maximise your tax efficiency.

Some of the services we can help your company with:

- Incorporate your limited company

- Year end company accounts

- Corporation tax return

- Confirmation statement

- VAT return filing

- Director self assessment tax returns

- Payroll

- Company registered office address

- QuickBooks bookkeeping software

- Bookkeeping

Whether you are venturing into a new partnership or are already established, we can have dedicated accountants who can assist your partnership business with all your tax and accountancy needs.

Here are some of the services we provide partnerships:

- Partnership annual accounts

- Partnership tax return

- Individual partner self assessments tax returns

- Payroll

- VAT tax returns

- Bookkeeping

Although being a sole trader is one of the simplest ways to get started in business, there are many processes that need to be followed. Here are some of the services we can help your sole trader business with:

- Sole trader annual accounts

- Self assessment tax return

- Payroll

- VAT return filing

- Bookkeeping

We help self employed individuals with the following:

- Self assessment tax return

- Self assessment HMRC registration