Sole trader business

- Powered by expert accountants

- Award winning software (QuickBooks)

- Quality service

- Fixed pricing + no hidden fees

Whether you’re looking to register as self employed with HMRC or file your self assessment tax return, we can help.

Forget about tax time stress

Our year-round tax support means you’ll never have to worry about missing a deadline again. We simplify your tax return filing.

Small business experts included

With online bookkeeping and real human support, it’s the expert financial solution your sole trader business deserves.

Accounting software

With QuickBooks’ online accounting software, you have all the tools you need to manage the finances of your sole trader business.

How we help sole trader businesses

We understand launching a start-up sole trader business is a big deal.

At Accounts Geek, we aim to keep everything simple and straight-forward. We offer a wide range of services from setting you up as self employed with HMRC to filing your self assessment tax return.

An all-star team means an all-time-great tax return. Bookkeeping and tax services from Accounts Geek ensure you’ll claim for every allowable expense you have incurred.

Sole trader accounting services

Preparing and filing your annual accounts is about a lot more than going through the motions. We’ll make sure your accounts stand up to scrutiny, but also that you’re on-track for meeting your goals and objectives.

We can prepare and file your company corporation tax return (form CT600) to HMRC. We ensure your company claims all the allowable expenses it has incurred to reduce the corporation tax bill.

Whether you need to run monthly or weekly wages, we will provide you with the support you need so you stay on top of all your requirements, saving you time and money.

Our compressive payroll support:

- Weekly, monthly or mixed payrolls

- Auto Enrolment (AE)

- New joiner/leaver administrations

- Processing complex gross pay elements and deductions

- Statutory payment calculations for sickness

- Statutory payment calculations for maternity, paternity and shared parental leave

- Administration of pension contributions, maintenance orders, student loans and earnings attachments

- Prepare payslips

- Holiday calculations

- Dealing with RTI and

- Auto Enrolment requirements

- Year end processing

- P60’s

- P45’s

We can prepare and file yours and any other company director’s annual self assessment tax returns.

Here at Accounts Geek, we’re always on the lookout for ways to help our customers, that is why we have sourced essential and critical Tax Investigation Insurance. This is a scheme that covers businesses, directors or individual taxpayers for any professional fees that may result from an investigation by HMRC.

We can help register your company for VAT or Payroll with HMRC.

Smart accounting software for sole trader businesses

Passionate about your business, but not about accounting? QuickBooks’ smart accounting software can help make your life easier. Send invoices, manage expenses and prepare your tax returns, all in one place. It’s the easiest way for sole traders to sort out their finances.

Send invoices on the go

Create your own branded invoices in an instant using our handy template. Get paid faster by adding PayPal’s ‘pay now’ button, or save admin time by setting up recurring invoices payable by GoCardless Direct Debit. See when your invoices have been opened and paid, and get reminders when they’re due.

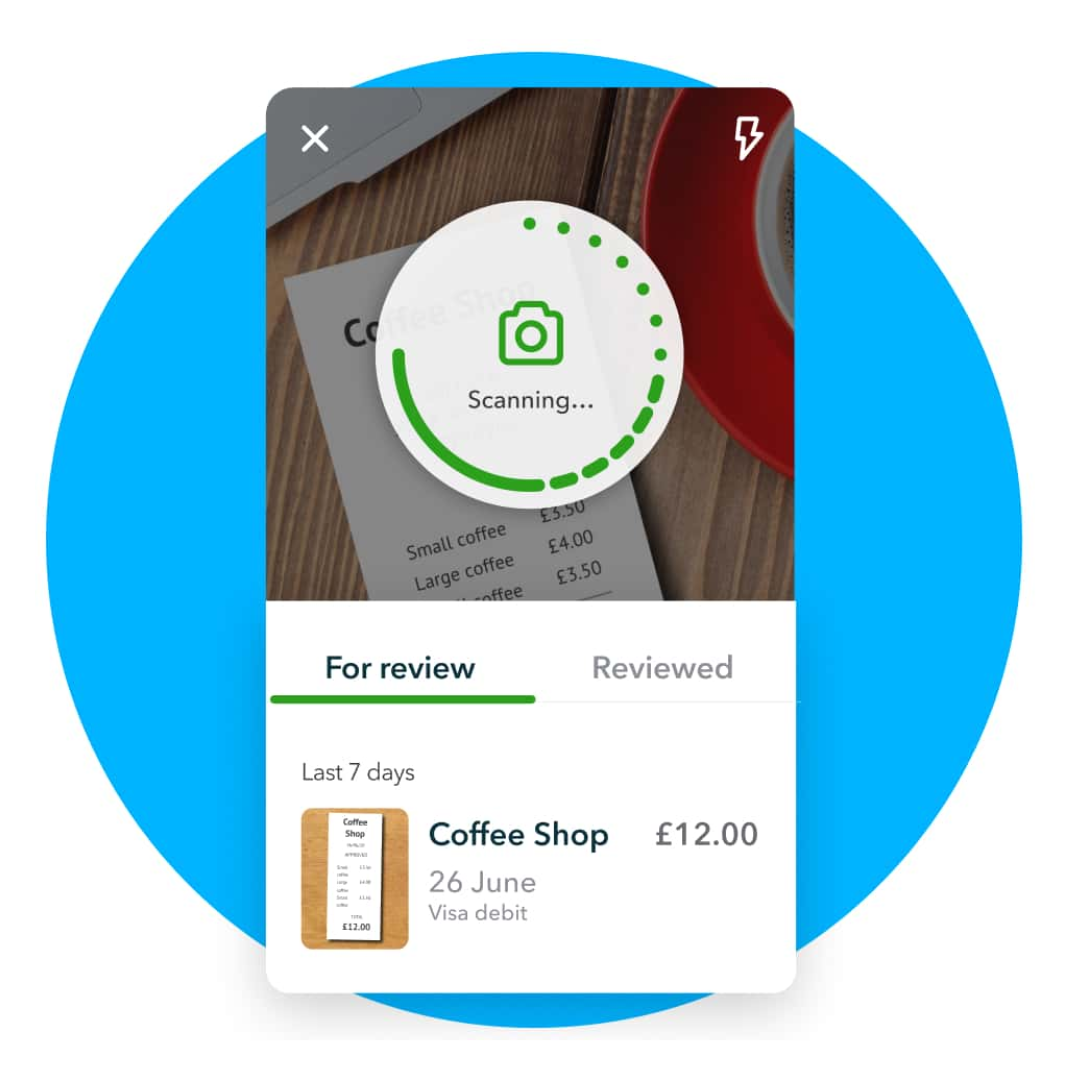

Deduct your expenses

Confidently claim expenses by snapping receipts and tracking mileage on the QuickBooks app. Say goodbye to data entry and let QuickBooks pull your bank data right into your dashboard.

Confidently claim expenses by snapping receipts and tracking mileage on the QuickBooks app. Say goodbye to data entry and let QuickBooks pull your bank data right into your dashboard.

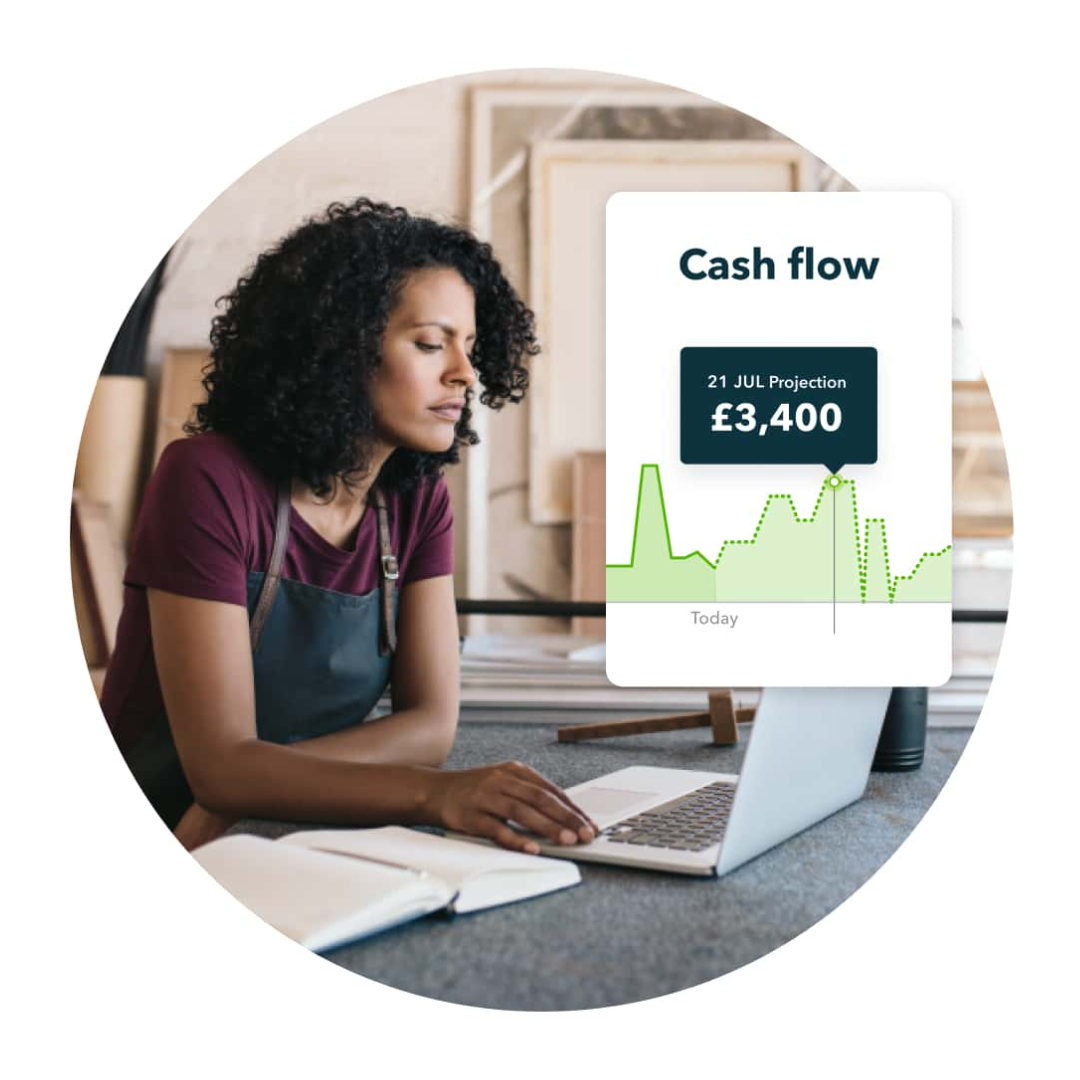

Forecast your cash flow

Get a glimpse into the future with real-time cash flow forecasts based on recurring expenses and transactions. Make better decisions based on instant insights that are easy to understand.

Experts at hand

Tax time stress isn’t limited to tax season. That’s why we offer year-round tax support services. With check-ins throughout the year, your tax team leaves no allowable expense deductions behind.

4 easy steps to join us

Speak with us

Complete our online form and our friendly advisors will contact you.

We set you up

Our friendly experts will help you get everything set up with us and HMRC.

Expert support

Our experts are on-hand to answer any of your questions.

All done

Congratulations, our simple sign up process is complete.

New customer discount - 10% off accountancy fees

We partner with the best