Limited Company Accountants

- Powered by expert accountants

- Award winning software (QuickBooks)

- Quality service

- Fixed pricing + no hidden fees

Whether you’re looking to incorporate a limited company or need help preparing and filing your annual accounts, we can help.

Forget about tax time stress

Our year-round tax support means you’ll never have to worry about missing a deadline again. We simplify your company tax filing.

Small business experts included

With online bookkeeping and real human support, it’s the expert financial solution your business deserves.

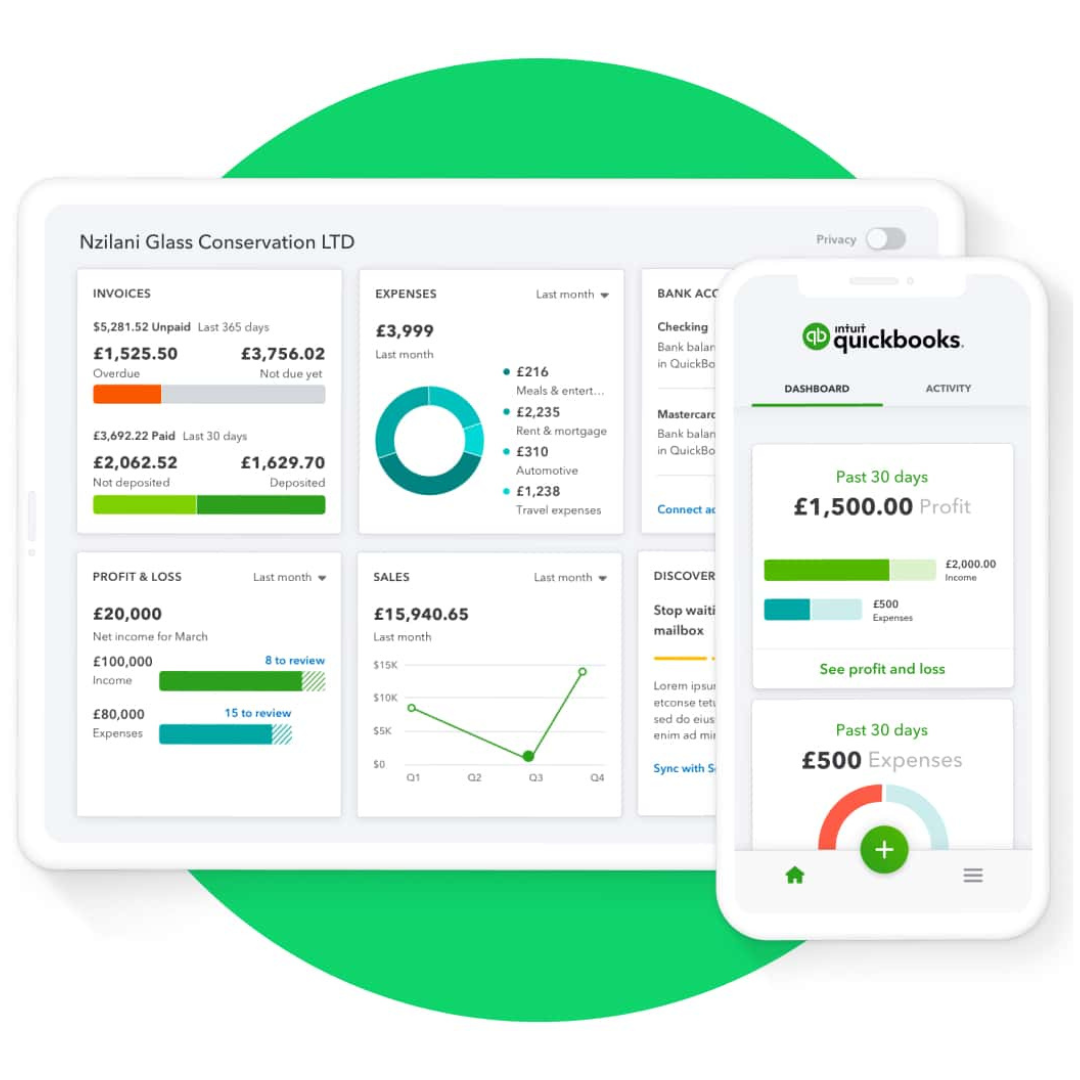

Accounting software

With QuickBooks’ online accounting software, you have all the tools you need to manage the finances of your limited company.

How we help limited companies

At Accounts Geek, we aim to keep everything simple and straight-forward. We offer a wide range of services from registering your limited company to filing your year-end accounts.

Running a limited company and being self-employed is difficult enough without having the extra worry of missing a tax deadline, making sure your tax submission is accurate and maximising your tax allowances. Choosing the right accountant is important to ensure you have all the support you need.

Limited Company accounting services

Preparing and filing your annual accounts is about a lot more than going through the motions. We’ll make sure your accounts stand up to scrutiny, but also that you’re on-track for meeting your goals and objectives.

We can prepare and file your company corporation tax return (form CT600) to HMRC. We ensure your company claims all the allowable expenses it has incurred to reduce the corporation tax bill.

Whether you need to run monthly or weekly wages, we will provide you with the support you need so you stay on top of all your requirements, saving you time and money.

Our compressive payroll support:

- Weekly, monthly or mixed payrolls

- Auto Enrolment (AE)

- New joiner/leaver administrations

- Processing complex gross pay elements and deductions

- Statutory payment calculations for sickness

- Statutory payment calculations for maternity, paternity and shared parental leave

- Administration of pension contributions, maintenance orders, student loans and earnings attachments

- Prepare payslips

- Holiday calculations

- Dealing with RTI and

- Auto Enrolment requirements

- Year end processing

- P60’s

- P45’s

We love to plan ahead which means we will get everything ready for submission well before your VAT deadlines. Of course, there is a bit of paperwork involved, but hey, hand it over to us to deal with, that’s what we are here for!

We can prepare and file yours and any other company director’s annual self assessment tax returns.

If you want to set up a private limited company in England and Wales, you’ll need an address for your business and for any directors that are listed. Our Business Address Service gives you both, use the address for your company and as the official correspondence address of its directors.

Our company registered address service is suited to all types of company structures, whether you’re limited company or PLC.

“Virtual Business Address” is just one that allows you to read and manage mail online. It’s still a physical street address that you can use in the real world, the only difference is that when post is received, it is scanned and forwarded to you by email.

Here at Accounts Geek, we’re always on the lookout for ways to help our customers, that is why we have sourced essential and critical Tax Investigation Insurance. This is a scheme that covers businesses, directors or individual taxpayers for any professional fees that may result from an investigation by HMRC.

We can help register your company for VAT or Payroll with HMRC.

Smart accounting software for small limited companies

If you’re a small Limited Company, you want accounting software that’s simple to use, yet advanced enough to meet your accounting needs. QuickBooks accounting software for small limited companies has all the features of advanced accounting software, but with no added complexity.

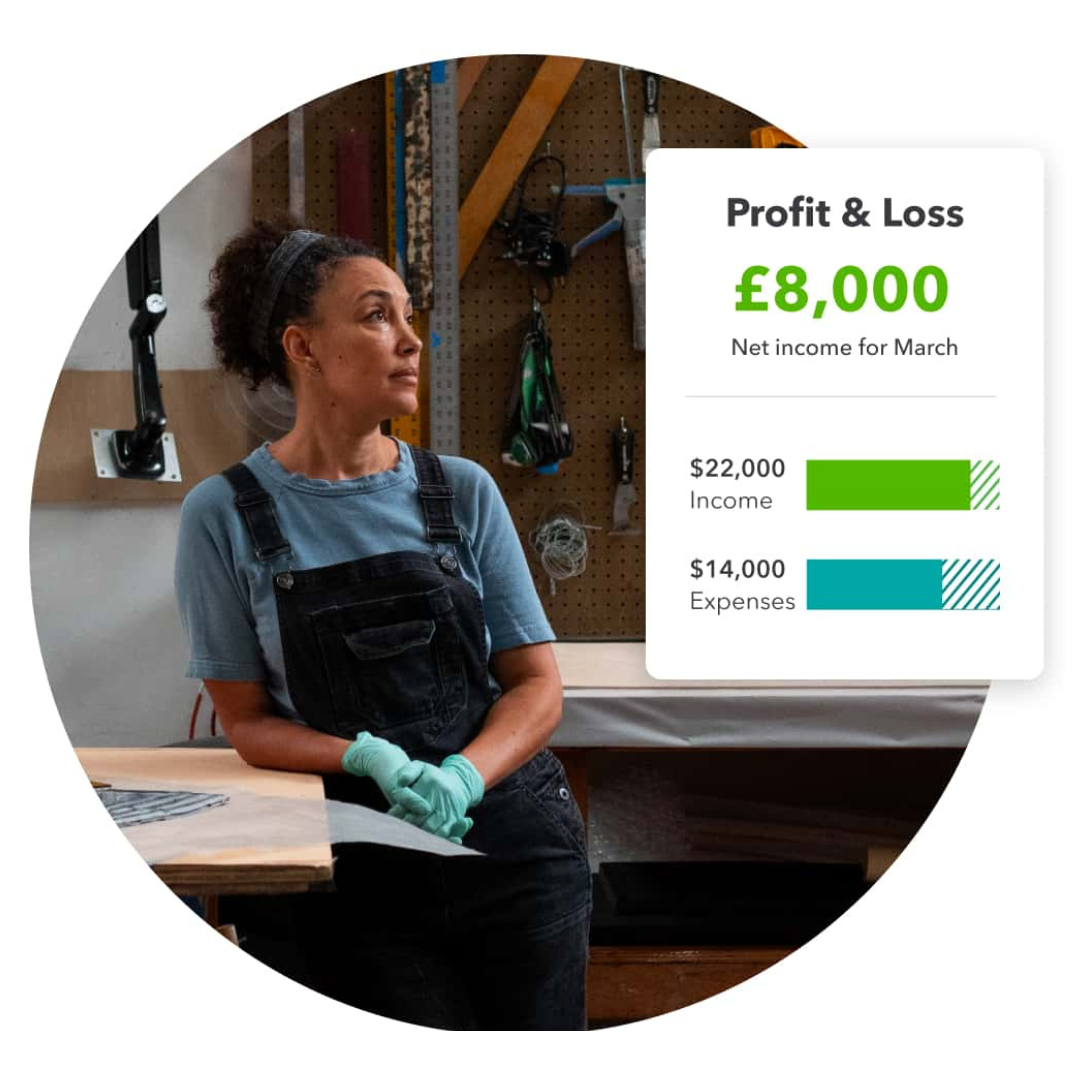

Manage your finances professionally

A Limited Company has more complex accounting needs than sole traders and freelancers. With QuickBooks’ full set of accounting features, everything you need is in one place.

Make smarter decisions

It’s easier to understand where to invest your time and money when you have a clear view of your business. Picture your profits at a glance from the real-time dashboard and run customised reports based on your key data.

Take control of your cash flow

See 24 months into the future with cash flow projections based on recurring income and expenses. Take action in plenty of time and understand how different actions could affect your financial future.

4 simple sign up steps

Speak with us

Complete our online form and our friendly advisors will contact you.

We set you up

Our experts will help you get everything set up with us and HMRC.

Expert support

We're are on-hand to answer any of your questions.

All done

Congratulations, our simple sign up process is complete.