Freelance individuals

- Powered by expert accountants

- Award winning software (QuickBooks)

- Quality service

- Fixed pricing + no hidden fees

Whether you’re looking to register as self employed with HMRC or file your self assessment tax return, we can help.

Forget about tax time stress

Our year-round tax support means you’ll never have to worry about missing a deadline again. We simplify your company tax filing.

Freelance experts included

With online bookkeeping and real human support, it’s the expert financial solution your business deserves.

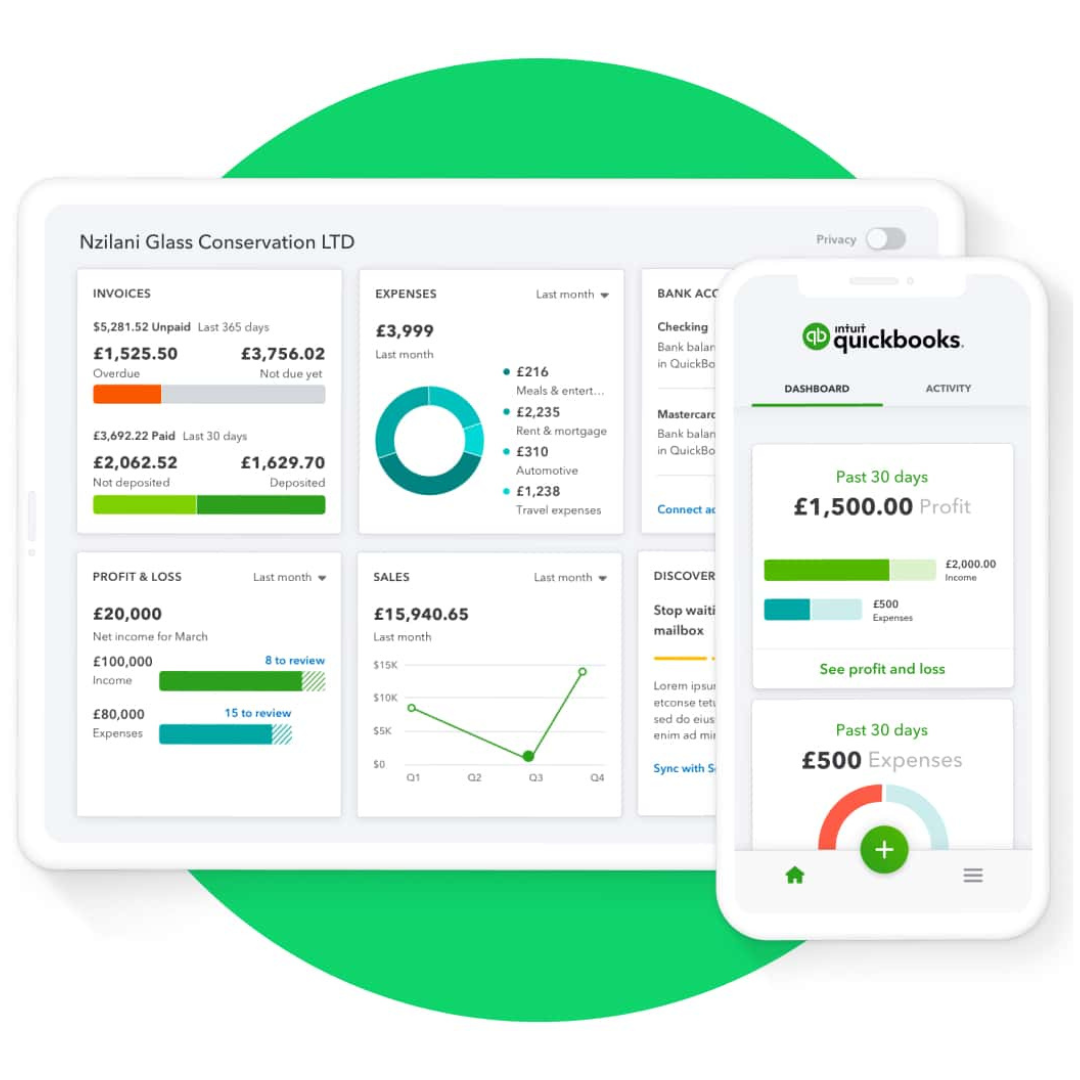

Accounting software

With QuickBooks’ online accounting software, you have all the tools you need to manage the finances of your limited company.

How we help freelancers

At Accounts Geek, we aim to keep everything simple and straight-forward. We offer a wide range of services from registering your limited company to filing your year-end accounts.

Running a limited company and being self-employed is difficult enough without having the extra worry of missing a tax deadline, making sure your tax submission is accurate and maximising your tax allowances. Choosing the right accountant is important to ensure you have all the support you need.

Smart accounting software for freelancers

If you’re a small Limited Company, you want accounting software that’s simple to use, yet advanced enough to meet your accounting needs. QuickBooks accounting software for small limited companies has all the features of advanced accounting software, but with no added complexity.

Self assessment tax return

It’s easier to understand where to invest your time and money when you have a clear view of your business. Picture your profits at a glance from the real-time dashboard and run customised reports based on your key data.

Self assessment tax return

A Limited Company has more complex accounting needs than sole traders and freelancers. With QuickBooks’ full set of accounting features, everything you need is in one place.

Self assessment tax return

It’s easier to understand where to invest your time and money when you have a clear view of your business. Picture your profits at a glance from the real-time dashboard and run customised reports based on your key data.

4 easy steps to join us

Speak with us

Complete our online form and our friendly advisors will contact you.

We set you up

Our friendly experts will help you get everything set up with us and HMRC.

Expert support

Our experts are on-hand to answer any of your questions.

All done

Congratulations, our simple sign up process is complete.

New customer discount - 10% off accountancy fees

We partner with the best