Classification of supplies for VAT

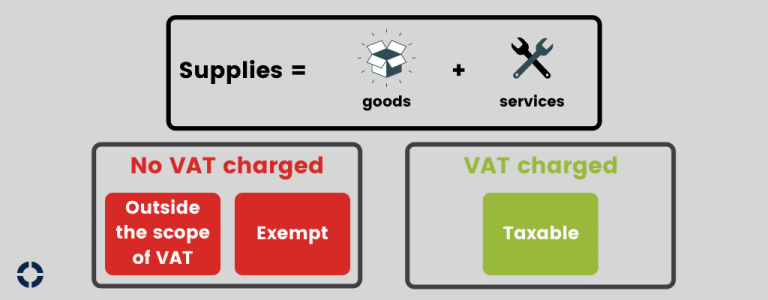

A VAT registered business may not need to charge VAT on the services and products they sell to their customers. This partially depends on the classification of the goods and services they offer. The term ‘supplies’ is used when describing the goods and services a business sells. It is important for a business to classify it’s supplies correctly to determine whether to charge VAT to its customers.

Supplies can be classified as either:

- outside the scope of VAT

- exempt

- taxable

VAT is only charged on taxable supplies.

Supplies outside the scope of VAT

Some goods and services are outside the VAT tax system so a business cannot charge or reclaim the VAT on them. Examples HMRC has given of out of scope items include:

- wages

- statutory fees – like the london congestion charge

- goods sold as part of a hobby – like stamps from a collection

- donations to a charity – if given without receiving anything in return

Exempt supplies

Exempt supplies are supplies that the law states should not have VAT charged on them. It includes items such as:

- Insurance

- Rent

- Postage stamps or services

- Health services provided by doctors

- Education (not for profit)

- Lotteries and betting

Taxable supplies

As mentioned above, VAT is charged on taxable supplies.

Taxable supplies are charged to VAT at different rates (zero rate, reduced rated and the standard rate). You can learn more about these rates here.

20th December 2021