Micro business accounting

Companies house classify a business as a ‘micro entity’ when they meet at least two of the following conditions:

- 10 employees or fewer

- Annual turnover of £632,000 or less

- £316,000 or less on its balance sheet

Experts included

Micro business experts always by your side

Bespoke pricing

Build your own package based on the services you require

Premium service

Same quality service, no matter the size of your business.

Simple yet sophisticated accounting

Just because your enterprise is classified as a micro business it doesn’t mean it cant benefit from innovative accounting solutions.

Our bespoke pricing solution is tailored to suit all types of businesses. This way a micro sized business can benefit from our competitive pricing rather than being forced into a small business pricing package.

- Bookkeeping

- VAT

- Payroll

- Monthly management accounts

- Micro entity accounts / annual statutory accounts

- Self Assessment Tax Return

- Limited company formation

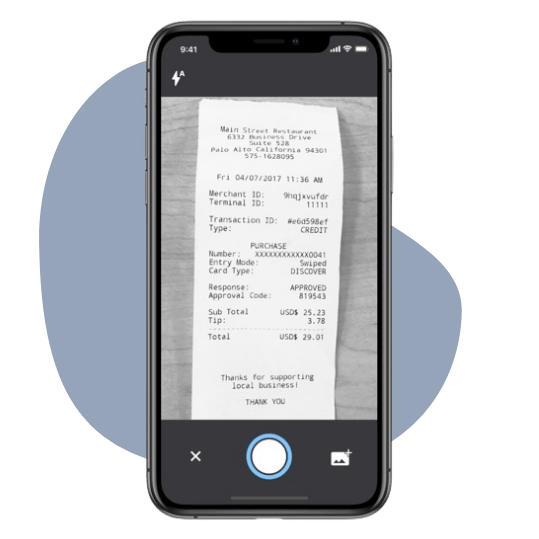

Expenses collaboration

- Snap your expense - upload or take a picture of your receipt.

- Confirm the information is correct - fill in the description and press submit.

- You're done - we will reconcile your bank statements, allocate your transaction to the right expense category

Invoices collaboration

- Create and send invoices directly to your customers from your mobile

- Full control of incoming payments - send late payment reminders in one click.

- Leave the accounting to us - we will allocate the transaction to the correct income category and ensure the double entry is complete.

Your dashboard

- Access your important business documents (e.g. HMRC letters) anywhere, at anytime, on any device, for no extra cost.

- Message your dedicated account manager whenever you have a query. We're always happy to help. Additionally, you can also contact us via email, mobile or telephone. Whatever suits you!

- View our receipts & invoices in your customer area

- Pay online through our secure payment portal