Experts at freelancer bookkeeping and accounting

How we help freelancers

As a freelancer keeping on top of paperwork and juggling between clients can sometimes mean your bookkeeping and accounting are not a massive priority on your to do list. This is many cases leads to missing important tax deadlines and confusion later on down the road as you reconcile records from several months prior. That’s why hiring an accountant can prevent fines, save you tax and ultimately act as your accounting pillar.

- Bookkeeping

- VAT

- Payroll

- Monthly management accounts

- Micro entity accounts / annual statutory accounts

- Self Assessment Tax Return

- Limited company formation

Frequently asked questions

A freelancer is a self employed individual, who works for different clients simultaneously on particular project.

One of the first things you need to do as a freelancer is register with HMRC as sole trader. This is to ensure you pay the correct national insurance and income tax.

Sole trader is a business structure that is registered with HMRC. In comparison, a freelancer is used to describe the type of work being carried out and isn’t associated to a legal business structure. A freelancer can either register as a sole trader, a limited company or a partnership

Flexibility – as a freelancer depending o the type of service you provide, you have more flexibility to choose the projects to work on, how long to work and what days to work

Be your own boss – you are the decision maker and have more control of the projects you work with alongside the business model you would like work at.

No commute – this depends on what service your provide but many freelancers have the luxury to work on projects from home rather than a traditional commuting job.

Irregular income – it’s very likely that a freelancer experiences a period where they do not as much as usual. This could be because they have completed projects and are awaiting to find more clients to work with.

Less benefits – if you want to go on holiday most of the times it means that as a freelancer you will not get paid. This also applies to when you want take time off if you’re feeling sick.

Invoices collaboration

- Create and send invoices directly to your customers from your mobile

- Full control of incoming payments - send late payment reminders in one click.

- Leave the accounting to us - we will allocate the transaction to the correct income category and ensure the double entry is complete.

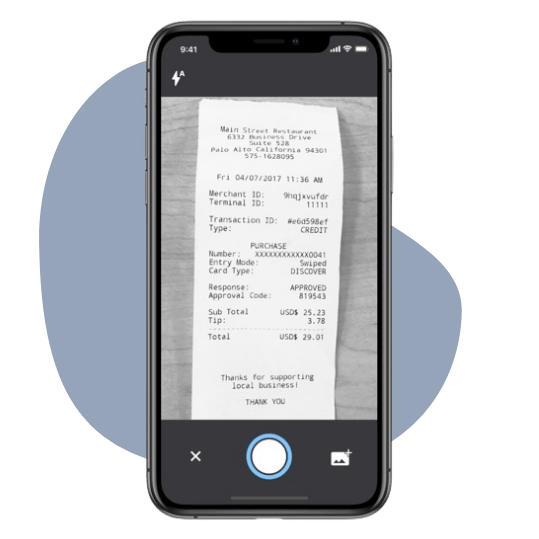

Expenses collaboration

- Snap your expense - upload or take a picture of your receipt.

- Confirm the information is correct - fill in the description and press submit.

- You're done - we will reconcile your bank statements, allocate your transaction to the right expense category

Your dashboard

- Access your important business documents (e.g. HMRC letters) anywhere, at anytime, on any device, for no extra cost.

- Message your dedicated account manager whenever you have a query. We're always happy to help. Additionally, you can also contact us via email, mobile or telephone. Whatever suits you!

- View our receipts & invoices in your customer area

- Pay online through our secure payment portal