Company Unique Taxpayer Reference

What is a Company Unique Taxpayer Reference

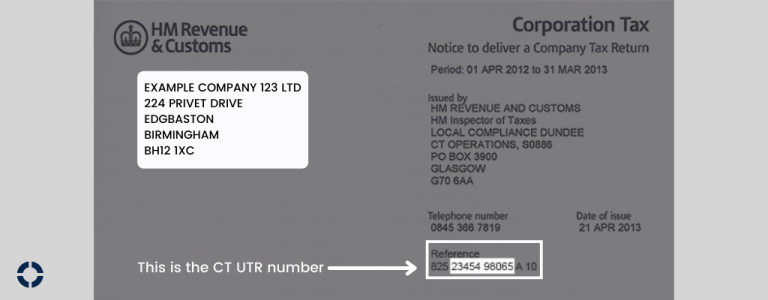

A company unique tax reference, also known as ‘tax reference’, is a unique 10 digit number, which HMRC provides to all new limited companies.

It’s important to make a a note of the company UTR or have it readily available, as a company will need it to file it’s tax returns, pay cooperation tax and register for other tax services such as VAT.

Where to find your company UTR

When a company is incorporated with Companies House, HMRC issues a letter, within 14 days of it being registered.

This letter is sent to the registered address of the company and contains the CT UTR, as shown in an example above.

The CT UTR can also be found on previous tax returns and other documents from HMRC, for example:

- notices to file a return

- payment reminders

If you cannot find your company UTR

You can request your Corporation Tax UTR online. HMRC will send it to the business address that’s registered with Companies House.

30th December 2021