Limited Company packages

All our packages include:

We will prepare and submit your limited company annual accounts to:

- Companies House

- HMRC (as part of your company tax return)

Your company’s annual accounts, also known as ‘statutory accounts’, are prepared from the company’s financial records (e.g. invoices and expenses) at the end of your company’s financial year.

A confirmation statement confirms the information that Companies House holds about your company is up to date. We will prepare and file this to Companies House.

It is compulsory to file a confirmation statement at least once every 12 months to Companies House.

Our year round support model means that we don’t just provide you with support during tax season, rather we’re always happy to support you. Our team is just one call away.

Manage your business expenses right from your mobile. Quickly snap your expenses. Create, send, track and record invoices on the go. Stay in tune with your financials with quick access to financial reports.

Your own dedicated accountant will get to know your business and answer any accounting queries you may have.

Our dedicated mobile support means getting in contact with your accountant is easier than ever.

Access your important business documents anywhere at anytime on any device, for no extra cost.

We will prepare and file your Company Tax Return to HMRC.

You must file your limited company tax return to HMRC every year. You are still required to send a return even if your limited company made a loss or has no Corporation tax.

By filing your company tax return you can work out your:

- profit or loss for Corporation Tax

- Corporation Tax bill to pay

Create and send invoices directly to your customers from your mobile.

Snap your expenses – upload or take a picture of your receipt.

Whether you need to register for payroll or VAT, we’ll handle your tax registration with HMRC on your behalf.

Connect your automatic bank feed to your app. We fetch transactions up to four times a day and help you record them.

All of our software and partnership solutions are Maxing Tax Digital (MTD) compliant.

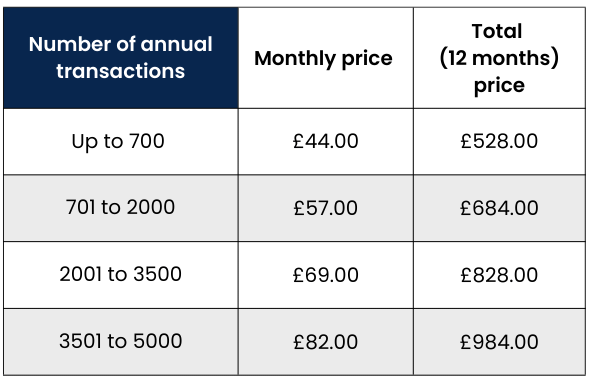

Select a package based on your monthly transactions

Under 40k

turnover-

Annual accounts

-

Confirmation statement

-

Free bookkeeping software

40k to 85k

turnover-

Annual accounts

-

Confirmation statement

-

Free bookkeeping software

85k to 200k

turnover-

Annual accounts

-

Confirmation statement

-

Free bookkeeping software

200k to 400k

turnover-

Annual accounts

-

Confirmation statement

-

Free bookkeeping software

Payroll

Payroll

All UK businesses running payroll need to be fully compliant with Real Time Information (RTI). Whether you need to run monthly or weekly wages, we will provide you with the support you need so you stay on top of all your requirements, saving you time and money.

We will set up and run your pay run for you on agreed timelines and provide email or physical payslips directly to your staff. We will apply all necessary deductions, e.g. National Insurance, PAYE, Bonuses, Pensions etc. and ensure calculations are done accurately and on time every time.

VAT

VAT

Your company will need to submit VAT returns to HMRC on a monthly, quarterly, or annual basis. The return summarises the VAT collected on sales and the VAT incurred on expenditure during that period.