A brief introduction to VAT

VAT is an indirect tax that is charged on most goods and services supplied in the UK.

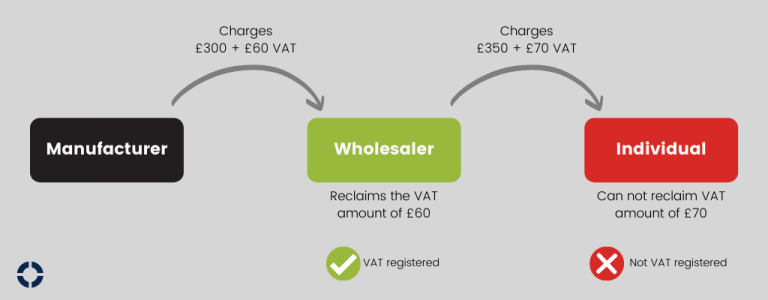

It’s classed as a consumer tax, which means that it’s only paid by entities that are not registered for VAT. This is because businesses that are registered for VAT can claim back the tax they’ve paid on purchases and expenses.

For example, a VAT registered manufacturer supplies goods to a wholesaler business and charges it £300 + VAT (£360 in total), which is charged at the rate of 20%. The wholesale business can reclaim the VAT amount of £60.00 (20% of £300) from HMRC, as it is registered for VAT.

The wholesale business then sells the goods to an individual for £350 + VAT (£420 in total). As the individual is unregistered, they can’t reclaim back the £70 (20% of £350) from HMRC and have to suffer the tax.

Compulsory VAT registration

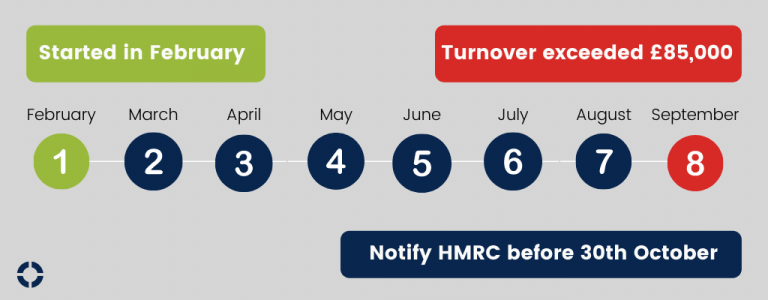

Not all businesses have to register for VAT. The current threshold is £85,000. This means that if a business has a total turnover for the last 12 months exceeding £85,000 (or since starting the business if this is less than 12 months ago), it is compulsory for them to register as follows; notify HMRC within 30 days of the end of the month in which the turnover exceeded the threshold.

For example, Mark started his business on 1st February. His monthly turnover is £11,000. Mark discovers that at the end of September 2021, his turnover for the last 8 months has exceeded the VAT registration threshold. It is compulsory for him to notify HMRC before the 30th of October.

Voluntary VAT registration

Even if it’s not compulsory for a business to register for VAT – they can still voluntarily do so.

Advantages of voluntary registration:

- Disguises the small size of the business

- Avoids any penalties for late registration

- Can claim back the VAT tax from HMRC, which is paid on purchases and expenses

Disadvantages of voluntary registration:

- The business may lose unregistered customers as it has to charge an additional VAT on its goods and services – the extra cost can not be recovered by unregistered customers such as the general public

- The business will have to comply with the VAT administration rules which may be an added administrative burden of maintaining paperwork

What must a VAT registered business do

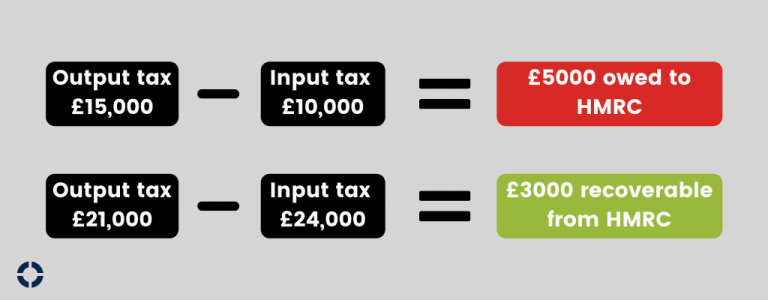

Most VAT registered businesses are required to file quarterly VAT returns to HMRC. This is done by calculating the total quarterly output tax (the VAT charged by the business on the goods and services it has sold) and the input tax (the VAT paid by the business on purchases and expenses).

The input tax is deducted from the output tax. If the output tax exceeds the input tax, then the balance is owed to HMRC. If the input tax exceeds the output tax, then the balance is recoverable from HMRC.

20th December 2021